-

How much in taxes is withheld from each Lottery prize? As required by Idaho law, the Lottery automatically deducts Federal and State income taxes from your winnings of prizes over $5,000. The Federal tax rate is 24% and the State of Idaho tax rate is 5.3%. The Lottery is also required to report winnings of $600 or over to the United States Internal Revenue Service and the State of Idaho Tax Commission.

When you receive your check, you will also receive three copies of your W-2 G forms detailing your taxed amount. You should keep these tax records safe until the following year when you will be required to use them. One copy is for your Federal taxes, one copy is for your State of Idaho taxes, and one copy is for your personal records.

For specific tax information, the Idaho Lottery suggests all winners consult a professional tax accountant, attorney or advisor.

-

If a group or pool of players claims a large prize, does every member pay taxes? When large groups of players claim a large jackpot prize, each player shares in the tax liability equally. Each claimant receives their W-2 G forms, which detail their tax liability along with a check for their portion of the remaining money.

If a group selects an annuity, taxes are removed each year based upon current tax laws before preparing the winners' annual checks. The Idaho Lottery must pre-pay taxes on winning amounts consistent with current Federal and State tax laws.

-

Do I have to pay Idaho taxes if I live in another state and win? Any person, 18 years of age or older, who legitimately purchases a lottery ticket in Idaho and wins, may claim the top jackpot prize. You do not have to be an Idaho resident or a citizen of the United States of America to play and win. The only difference between these players and Idaho residents is how you claim your winning prize and handle your tax liabilities.

Non-Idaho residents claim their winnings as a non-resident United States citizen. You must present photo identification that establishes your location of legal residency. During the following year in April, you will need to file an income tax return for all monies earned (winnings included) in the State of Idaho.

United States citizens may also receive a credit on their state of residence income tax return for the monies you have paid to the State of Idaho. You will want to confer with your tax advisor on whether you owe any additional taxes on this income in your resident state.

-

If I live in another country and win the Idaho Lottery, how do I pay my taxes? Jackpot or large prize winners who live in countries other than the United States of America are considered non-resident aliens. Upon presentation of your winning ticket, you must also demonstrate with legal photo identification documentation of your country of residence.

The withholding tax rate for non-resident aliens at the Federal level is 30%.

Non-resident aliens of the United States of America who earn money in the United States (including lottery winnings) are required to file a non-resident United States tax return and to file a non-resident Idaho tax return. You will want to consult a tax advisor in your resident country and one in Idaho to ensure that your taxes have been paid or credited appropriately.

-

Can a player write-off Lottery losses on federal taxes? If $600 or more is won on a single wager, the Lottery is required to report those winnings to the IRS. The Lottery is not qualified to give advice on matters regarding taxation. Players are encouraged to consult a tax professional regarding this matter.

-

What happens to prize money if the winner passes away? If a winner passes away before receiving all of the prize payments, the remainder of the prize money will be issued to the winner's estate.

-

Can't decide on Cash or Annuity? A change in the IRS code will allow you to make the cash versus annuity decision after you have won a jackpot. The Idaho Lottery Commission's policy stated as follows: "It is the policy of the Idaho Lottery Commission to allow on-line jackpot winners to defer for sixty days following the presentation of the winning ticket, an election as to whether to receive the prize in the form of an annuity or a single cash payment as a procedure in the rules of the game. The election, once made, is binding and cannot be changed without the specific approval of the Idaho Lottery Commission."

-

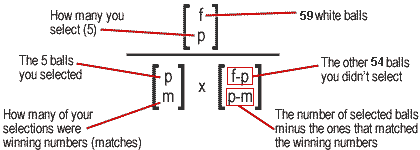

How do you calculate the odds of winning the Powerball jackpot? - The total number of balls (numbers) you are choosing from, which is called the field or (f).

- The number of balls the player selects on his\her play slip, which is called the pick or (p).

- The number of correct matches between the player's picks and the numbers drawn out of the machine, which is called the match (m).

Many people ask us to explain how their chances of winning are determined. So, let's start at the beginning!

The Powerball game is played by selecting five numbers out of 59 choices (the numbers from 1 to 59), and by selecting one extra number from 1 to 35 (that's the Powerball). When it's time to draw the winning numbers, there are two machines tumbling the ball sets at the same time: one machine has the 59 white balls, and the other one has the 35 red "Powerballs." So the Powerball game is like holding two drawings at the same time; two independent events played simultaneously. Any chances of winning the game has to consider what happens to the number selections within one drum combined with the possibilities of what's happening in the other drum. That idea is really important to keep in mind. A winning set of numbers will be whatever five balls are selected out of the white-ball drum plus the one ball selected from the red-ball drum.

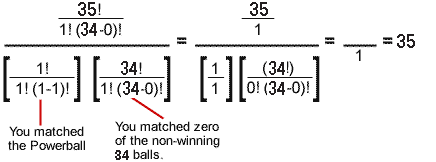

But the chances of winning look confusing because even at the smallest winning level (just getting the Powerball right), many people think the chances of winning should be 1 in 35 (one correct choice out of a drum of 35 balls, right?). But we're not just playing that one drum; in order to say you "only matched the Powerball" that means you have to have missed all five of the white balls that were chosen in that other drum! The chances of doing that combined with your 1-in-35 shot of getting the Powerball actually come out to being 1 in 55. In other words, there is one chance in 55 that you'd pick the winning Powerball number and miss selecting any of the five winning white-ball numbers.

So when you hear a "chances of winning" calculation, it's describing the chance that you will have chosen the winning numbers including the chances you chose numbers that didn't get drawn. Since there are several ways to win, (from zero to all five of the white balls, with and without having the Powerball) that means people who calculate the chances of winning have to figure each level of winning or not winning in each of the two drums. For example, in order to win the big jackpot, a winner must have chosen all five white balls correctly, as well as the Powerball number. To describe the chances of winning, you have to say what your possible chances are of choosing the winning balls against choosing any of the 55 non-winning balls in the one drum, combined with your chances of choosing the winning Powerball against choosing any of the 34 non-winning red balls in that drum. That's a lot of combinations! More than 175 million, in fact. But there's an easy formula that gets you there (okay, maybe not that easy).

Where do you start? Well, the general math formula for calculating lottery chances will combine three things:

The mathematical formula looks like this:

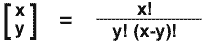

Each part of that formula, which is in parentheses, is a "binomial coefficient," which is a calculation on how many ways there are to make different combinations. In our case, we're talking about how many combinations of lottery balls you could make with a set of 59 (or 35) balls. What that means is that for whatever numbers you have, the binomial can be rewritten as follows:

X! means "x factorial"; for example, 5! is 5 x 4 x 3 x 2 x 1 =120.

Now we're ready to look at winning that jackpot!

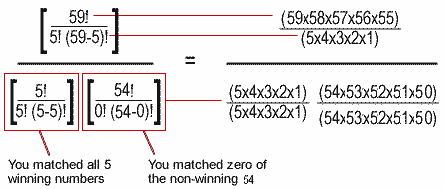

To do that, we said you'd have to describe the chances of picking five numbers including 54 non-winning ones out of a total of 59. Then you combine that with the figure to describe your chances of picking one winning Powerball number including choosing 34 non-winning numbers. So using our binomials and factorials, it looks like this: POWERBALL CHANCES OF WINNING THE JACKPOT: (5 of 5 plus the Powerball)

So, 59 x 58 x 57 x 56 x 55 = 600,766,320 and 5 x 4 x 3 x 2 x 1 =120; divide one by the other:

600,766,320 / 120 = 5,006,386 (chances of 5,006,386 to 1 of picking all 5 white balls out of 59)

And don't forget that now we have to combine the possibilities of choosing the Powerball, which we know is one in 35. That formula works just like the one above:

So, 5,006,386 / 1 x 35 / 1 =175,223,510.

Now, that's just one win scenario: the big jackpot. But you can also win eight other prizes ranging from $1,000,000 to $4.

(In order to win a prize, your Powerball number must at least match the Powerball number drawn, or you must match at least three of the five white-ball numbers drawn.)

When you combine the chances of all those levels and all those combinations, it comes out to roughly 1 in 32.

So each player has a 1-in-32 chance to win any of the prizes (jackpot, $1,000,000, $10,000, $100, $7, or $4)!

We hope this helps to better explain the chances of winning the Powerball jackpot.

-

What does "overall odds of winning" mean? The odds printed on the back of the Idaho Lottery Scratch tickets are the overall odds for the entire quantity of tickets printed for the specific game indicated. The odds are calculated by taking the total number of tickets printed divided by the number of winning tickets. The winning tickets are randomly distributed, therefore it is possible to purchase several tickets without having a winning ticket, just as it is possible to have them all be winning tickets.

-

Can I buy tickets on the internet or through the mail? There are no laws in Idaho that allow for purchasing tickets over the Internet or through the mail. To buy tickets, players must visit an authorized retail location in Idaho.

-

How can I automatically receive the winning Powerball numbers after the drawing? To sign up to receive the winning Powerball PowerPlay numbers or any other winning numbers from games by the Idaho Lottery click on "VIP Club" located above right, in the menu bar. Follow the simple instructions. Members can choose to receive either e-mail alerts or text messages to their cell phones regarding the winning numbers.

-

How long can a player wait to claim his or her prize? Idaho Lottery players have 180 days from the draw date for all Draw Games and 180 days from the official end of the game for Scratch games to claim their prize.

-

How do I locate past winning numbers? Click on one of the following Draw Games™ to get the downloadable list:

-

Could you be missing money? Could you be missing money? There could be money from uncashed Lottery winner checks, stocks, a tax refund, dormant bank accounts or even insurance benefits that could be owed to you. Each year funds are reported when rightful owners can't be located. This can happen with a change of address, name change, undelivered notices or when mail is misplaced or just forgotten. That money can be returned to you by simply searching your name and filing a claim online.

The Idaho Lottery reports uncashed winner checks to the State of Idaho each year and they are posted at this link! The search is quick and easy and is always free!

What's not to love about that??

Find unclaimed property or money from the official Idaho website: